The Cloud Platform Bilendo is available with the following products.

You can request our prices at any time.

Basic functions of the Bilendo Cloud Platform

Quick to connect, easy to use

Internal flexibility

Enterprise information security

Exporting

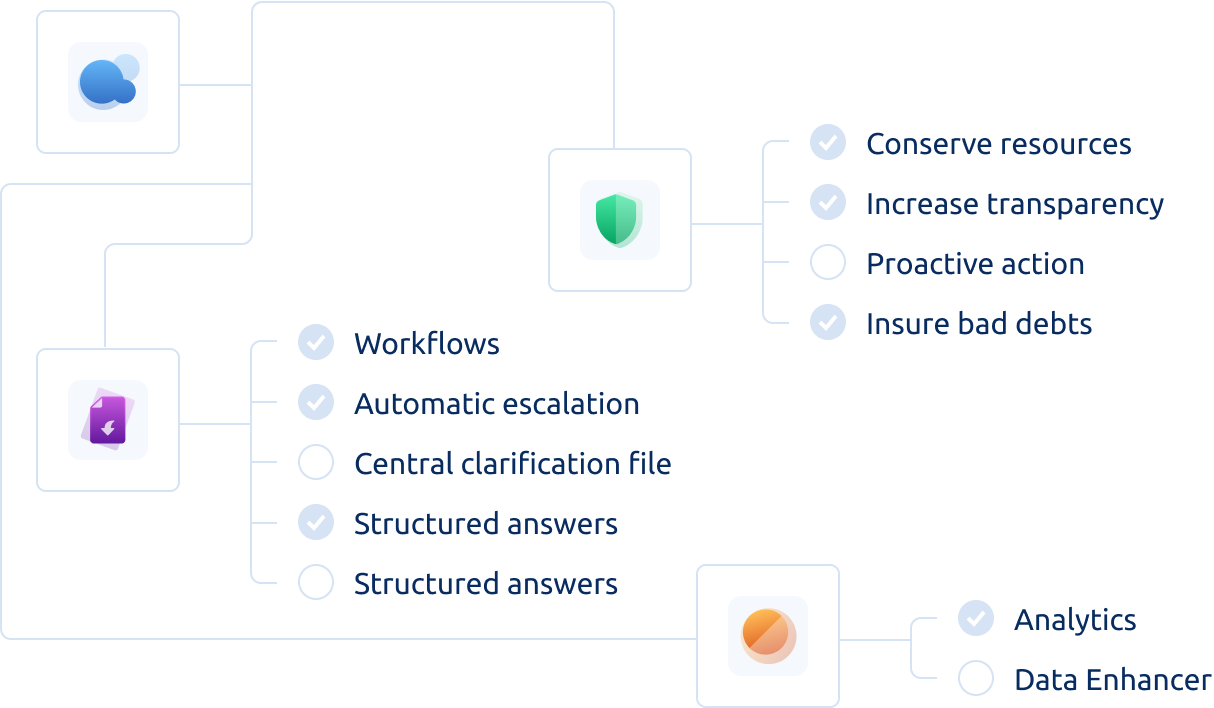

Base features of our product solutions you can combine with the Cloud Platform

Clarify open items

Intelligent dunning blocks

Daily Reminders & Clarifications

Daily-automatic dunning process

Efficient Credit Management

Seamless integrations

Improve limit decisions

Personalized scoring

Base features of our add-ons to combine with the Cloud Platform and Products

Analytics

Data Enhancer

DSO Reduction

Bilendo increases efficiency through intelligent dispute workflows and a daily rolling dunning process, thereby enabling a reduction in receivables collection times.Process Costs

Intelligent automation significantly reduces manual process steps and requires fewer resources for processing.Custom pricing

Integrate your tailored solution of Bilendo to make your credit management more efficient.

Request pricing

Success Stories

Many well known companies have already implemented and use Bilendo. Read about some of their successes here.

All Success Stories

faq

Find our most frequently asked questions below.

The Bilendo platform consists of several products and add-ons that comprehensively cover the O2C process:

Products:

Cloud Platform: The Cloud Platform product forms the basis for using the Bilendo platform as the Data Hub. Here, data from various sources is consolidated and made available for use in subsequent processes or analyses.

Receivables: The Receivables product automates end-to-end processes in receivables management. This includes deductions, internal clarifications, dunning, and customer correspondence.

Risk: The Risk product enables comprehensive management of credit limits and risk assessments. This includes connecting trade credit insurers and credit agencies, risk scoring, calculating credit limits, validation and approval processes, risk alerts, and order blocking and approval.

Add-Ons:

Analytics: The Analytics product is used to create dashboards and analyses that can be used for management reporting or process monitoring.

Data Enhancer: The enhancer enriches document data with additional information, thereby creating the basis for a single point of truth in receivables and credit management.

The Cloud Platform must always be used as the basis for using the Bilendo platform. All other products are modular, whereby holistic platform use brings considerable added value due to the interdependencies between individual processes.

Together with our sales department, a fixed annual price for using the platform is determined based on the scope and business case. This price is payable annually in advance and remains unchanged for the duration of the contract.

The investment in Bilendo includes technical integration, interfaces to trade credit insurers and credit agencies, platform configuration, training, support, and maintenance, as well as ongoing platform development.

Costs for mailing reminders and customer letters are billed monthly on a transactional basis and are not included in the usage fee. Costs for trade credit insurance and credit agencies are not included in Bilendo usage.