Optimize your credit management with adaptable processes, seamless integrations and targeted automation.

Experience Contact Sales

Conserve resources

Reduce effort and costs through automated workflows, efficient process design and seamless integration with external credit agencies.

Increase transparency

Ensure traceability of limit decisions based on comprehensive evaluation of internal and external information.

Proactive action

Make informed decisions by identifying risks at an early stage using automated workflows.

Insure bad debts

Minimize losses effectively with preventive credit checks and fully integrated trade credit insurance.

Risk

Optimize your limit decisions with our powerful platform that provides you with comprehensive insights and efficient tools to make informed decisions.

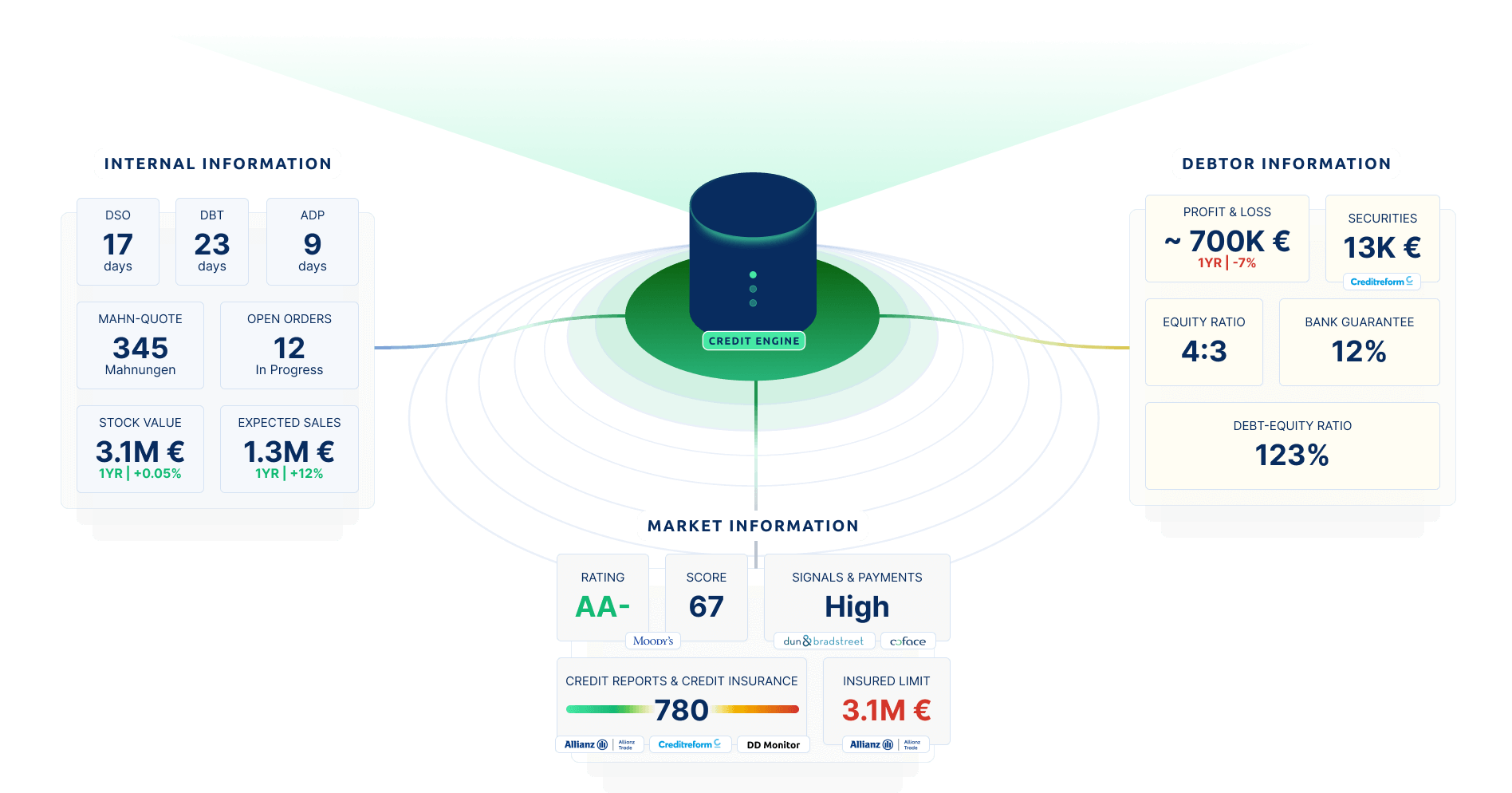

360° Overview

Get a comprehensive overview of all relevant risk parameters with the 360° overview. All important information is displayed in a bundled form to enable efficient decision-making.

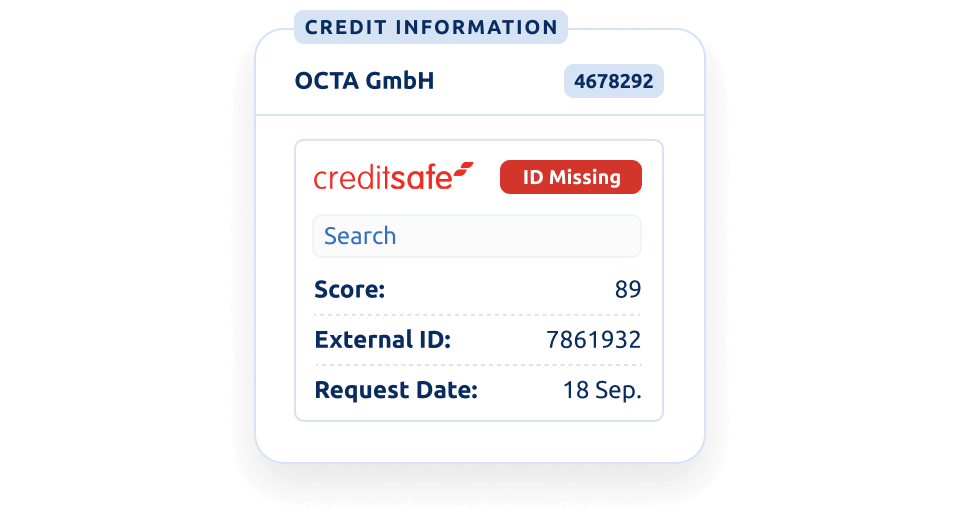

Automated limit suggestions

Use customized recommendations to optimize your limits based on your requirements and current data.

Individual limit application

Capture all information in configurable applications quickly and accurately to standardize and speed up processing and approval.

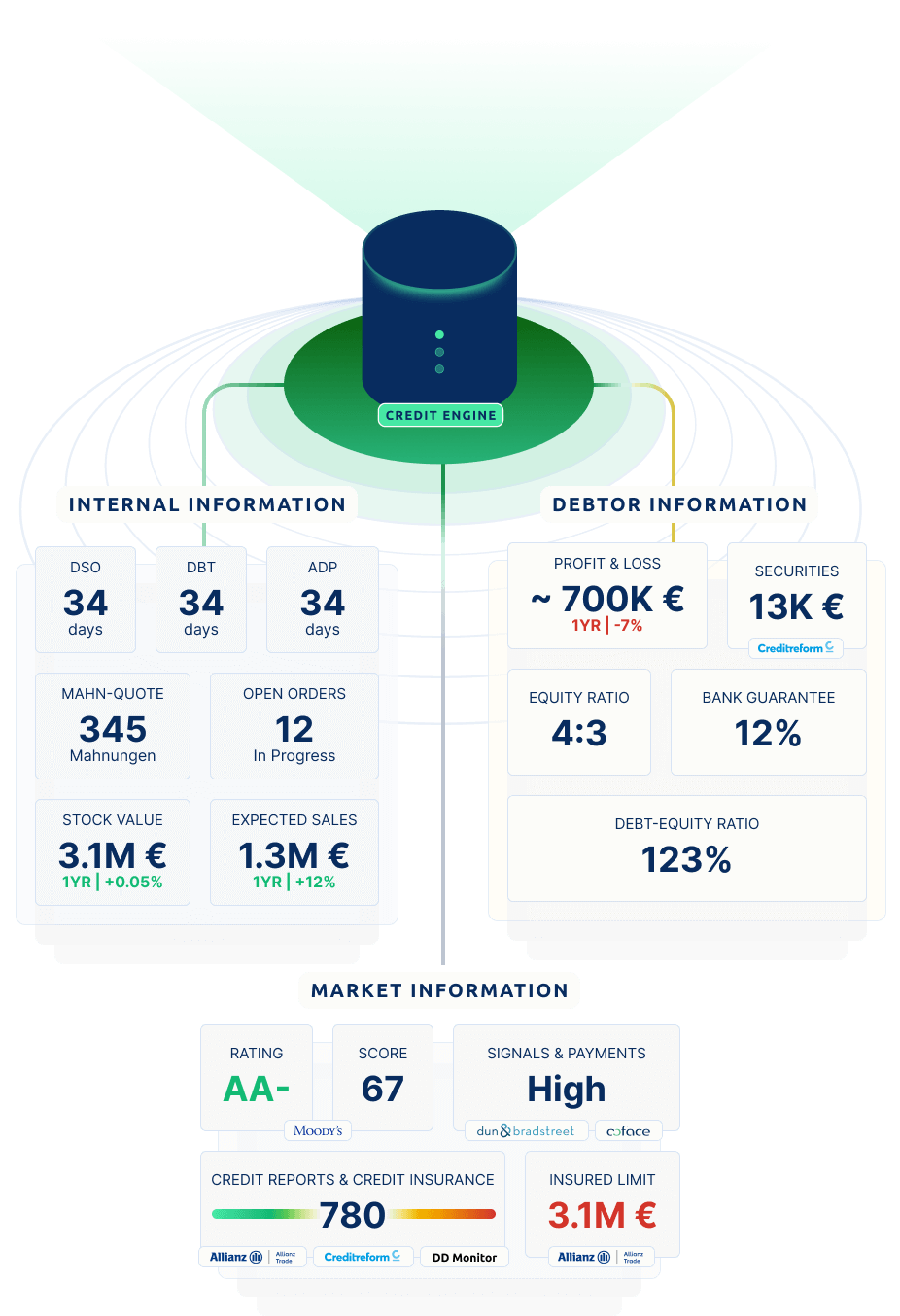

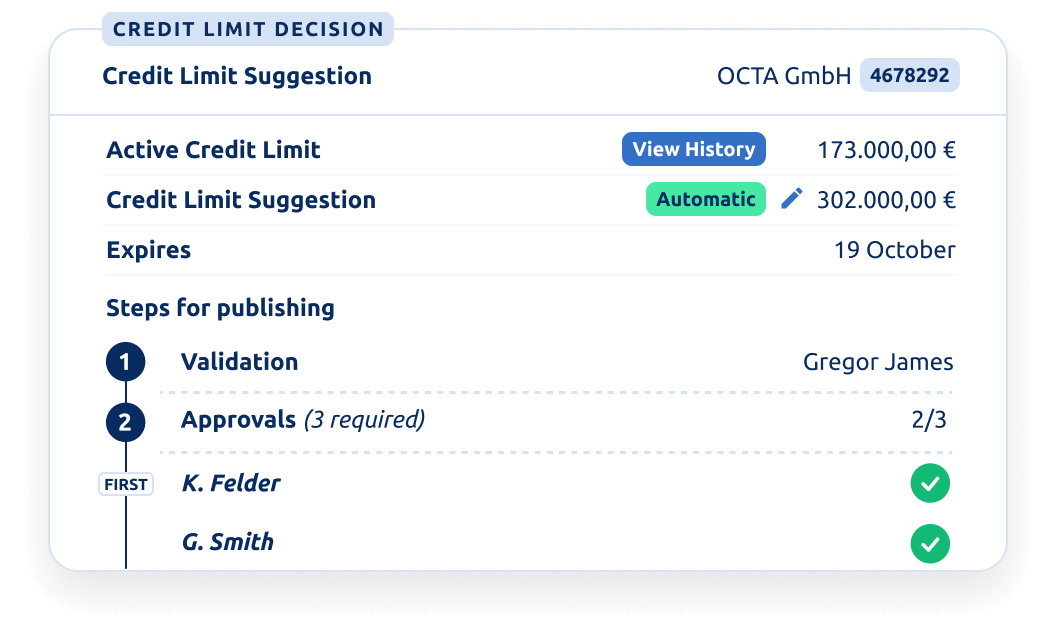

Compliant limit approval

Easily store different approval processes for a compliant and individual credit limit release.

Transparent limit history

Track all changes and adjustments to your limits and get a clear overview of previous adjustments with detailed records.

Risk

Obtain and request information and insured limits directly via the platform to avoid media disruptions and reduce costs.

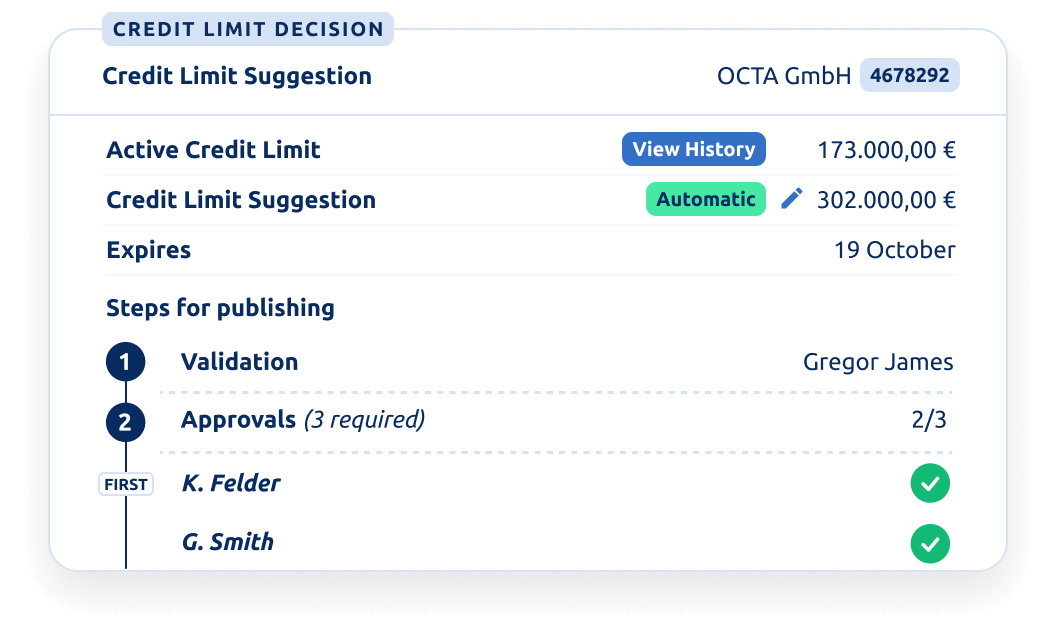

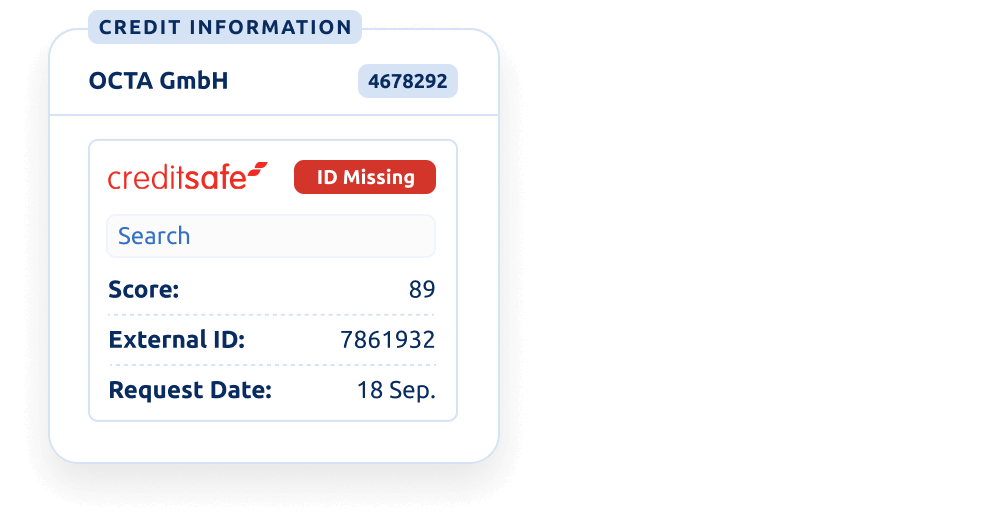

Connection to credit agencies

Retrieve reports from all common credit agencies with just a few clicks and integrate the data into your internal scoring.

Integrated monitoring

Reduce manual effort when making changes to reports with fully integrated monitoring tailored to your credit agency.

Credit insurance industry integrations

Insure and manage cover with trade credit insurers with just a few clicks directly via the platform.

New customer query

Check the creditworthiness of your new customers and decide whether and to what extent a credit limit should be granted.

Risk

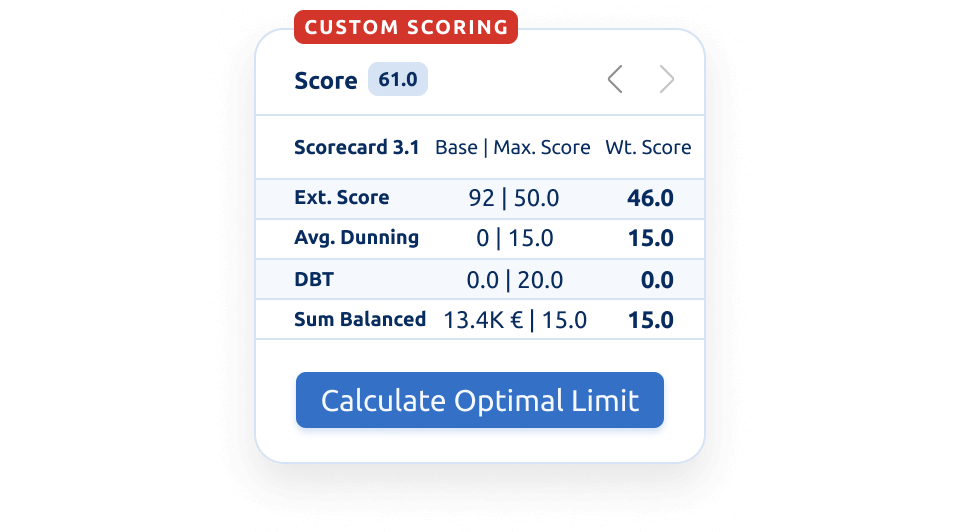

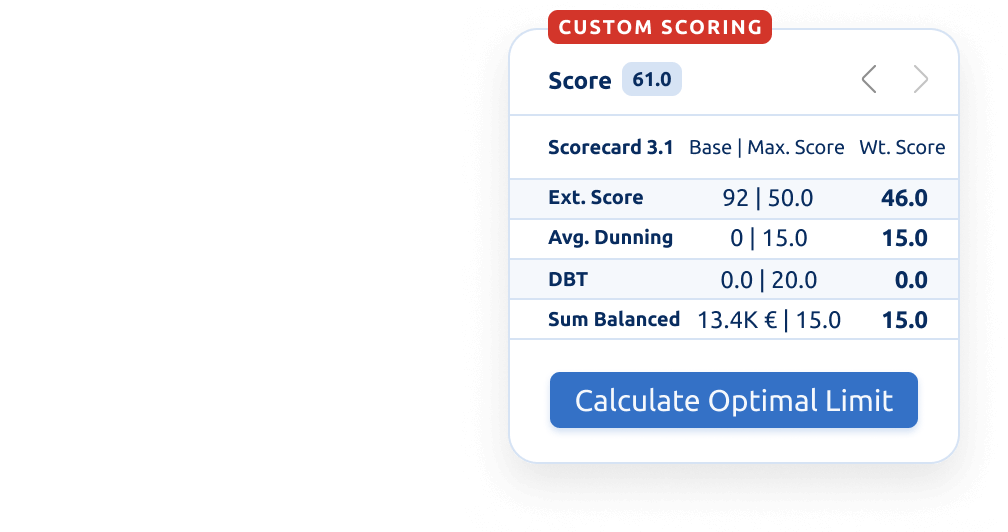

Evaluate your customers with customized scorecards that take into account your specific market conditions and years of experience.

Individual scorecards

Benefit from our customized scorecards, which have no limits in terms of the number of parameters or specific logic.

Internal and external sources of information

Combine internal information, such as payment history, with external credit agency data to obtain a more accurate and meaningful score.

Multiple scorecards

Manage different scorecards in different areas of your business to enable customized assessments for specific requirements and processes.

Recommended credit limit calculation

Automatically calculate your optimal credit limit based on the score and other parameters to make the best possible decisions.

Risk

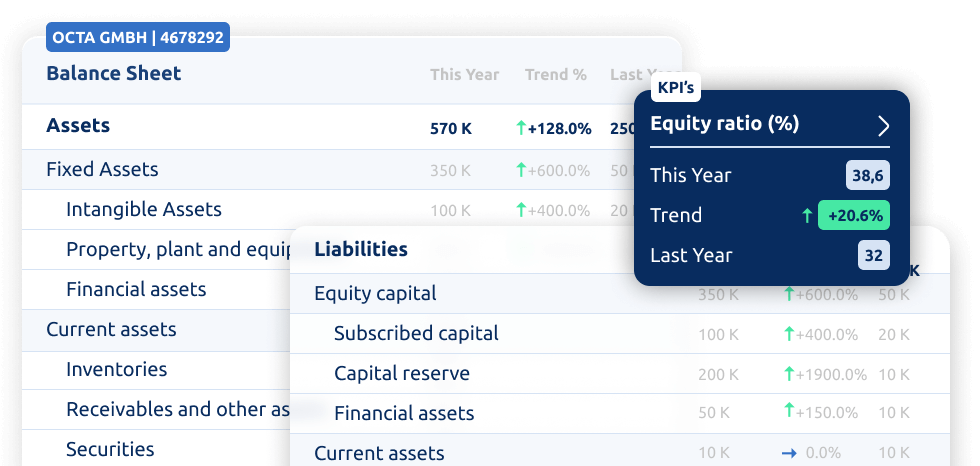

Analyze balance sheets

Perform comprehensive balance sheet analyses to assess the creditworthiness of your most important customers and ensure their stability for your business processes.

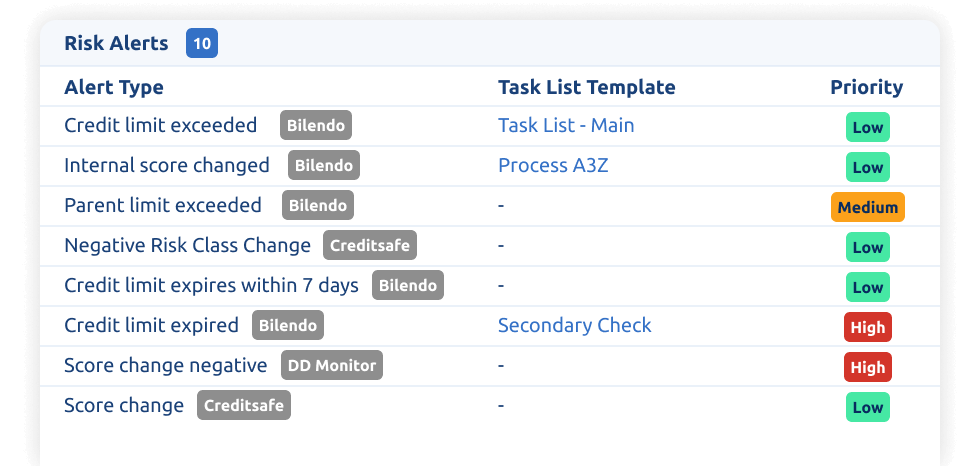

Risk alerts

Receive immediate notifications of changes to external scores, adjusted cover and more with flexible risk alerts so you can react quickly.

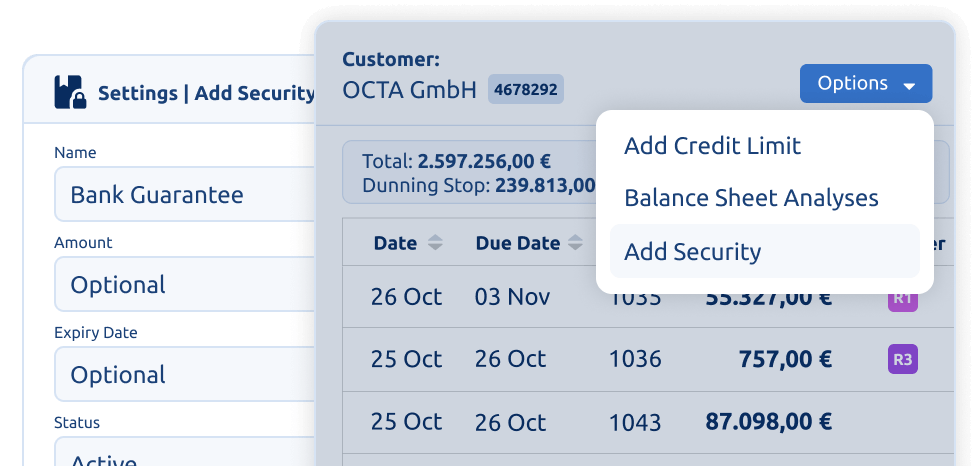

Create collateral

Create securities such as guarantees directly in our software and store them directly in the customer profile.

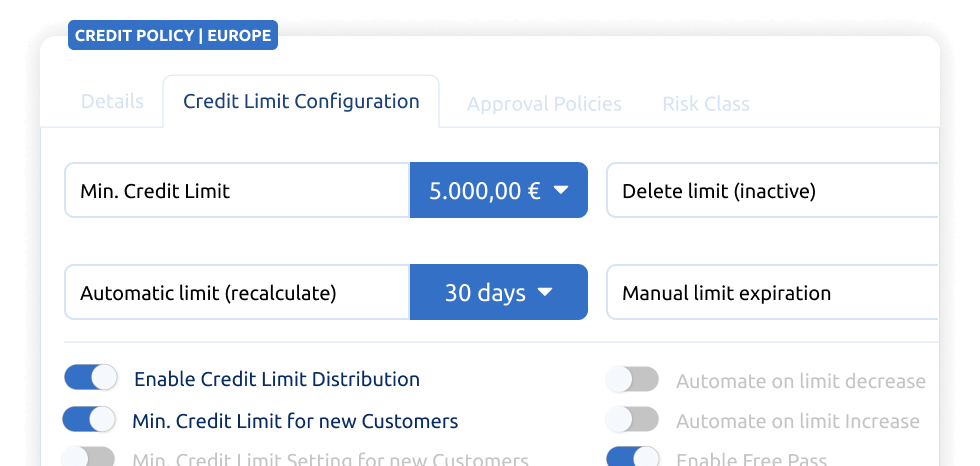

Flexibly adapt credit policies

Adjust your credit guidelines flexibly to ensure self-determined and market-driven management of lending.

Risk +

Expand your accounts receivable processes with the additional products and add-ons available in Bilendo.