Integrate your data with little effort and control your accounts receivable processes with the help of our modern platform.

Experience Contact Sales

Simple data integration

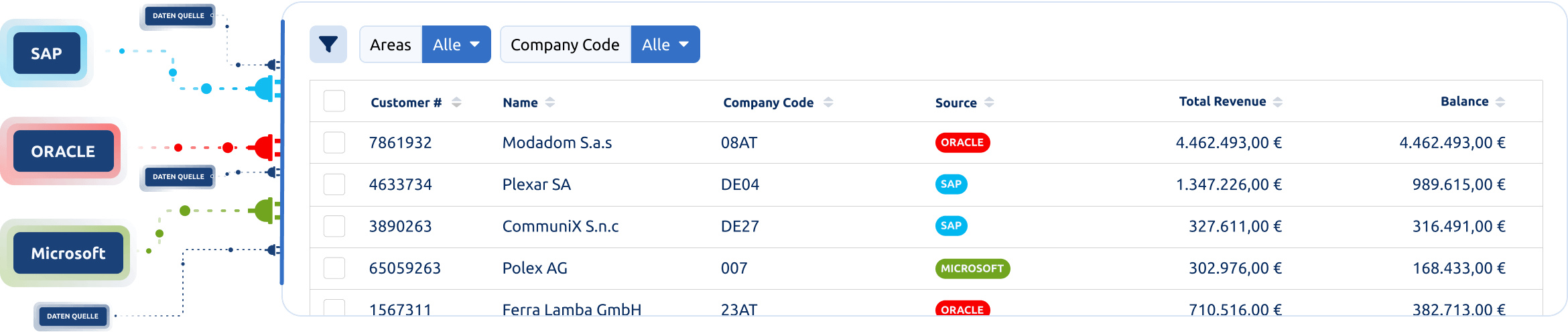

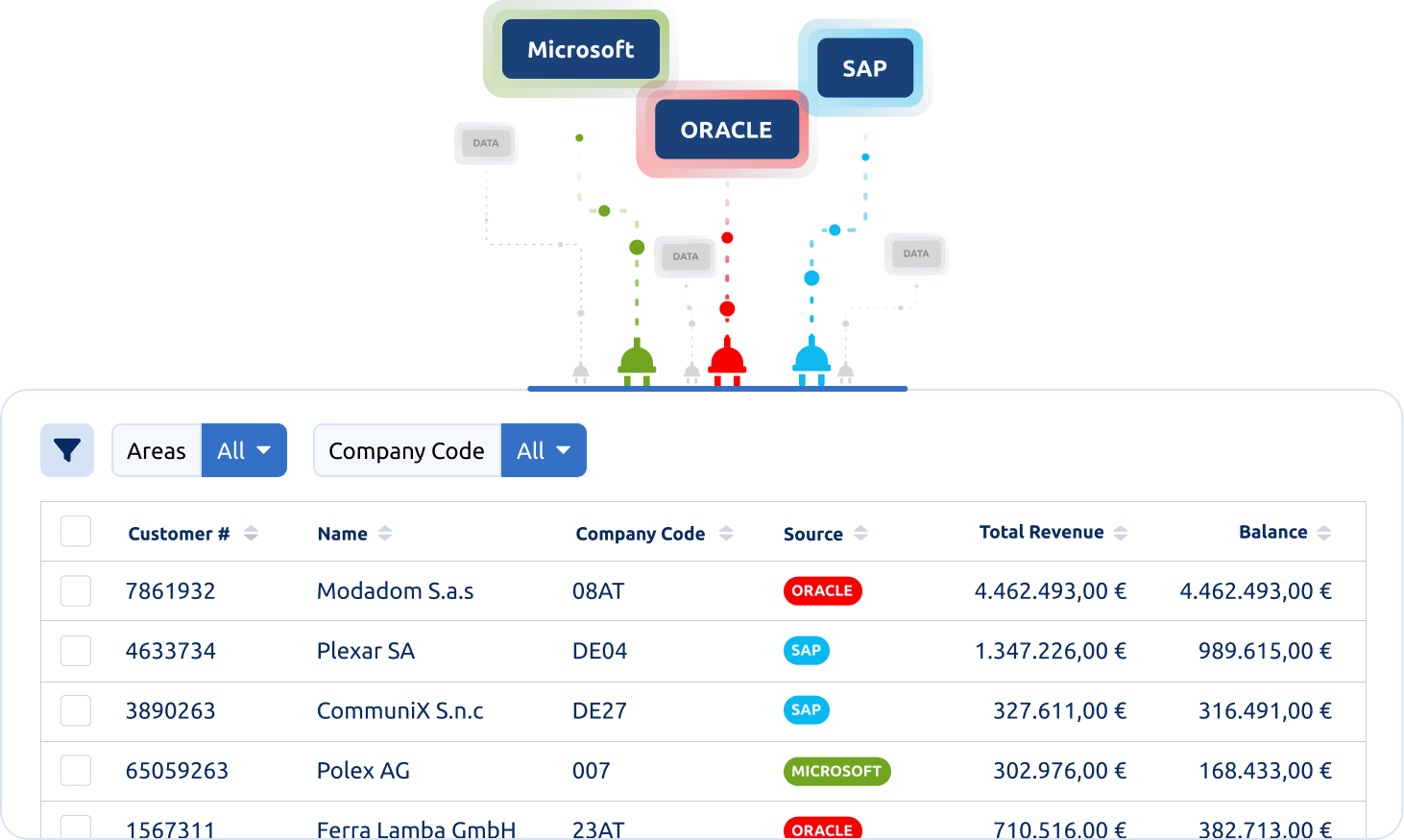

The import of large volumes of data takes just a few seconds and is automatically monitored for integrity around the clock.

Configuration in your own hands

You know best how you want to use Bilendo. That's why you can configure the platform entirely according to your wishes.

Lightning-fast search & filter

Even with large amounts of data, you always have the fastest possible access. With the global search, you can find what you need immediately.

Limit access rights

Maintain full control over who can view which data and which functions your users can access.

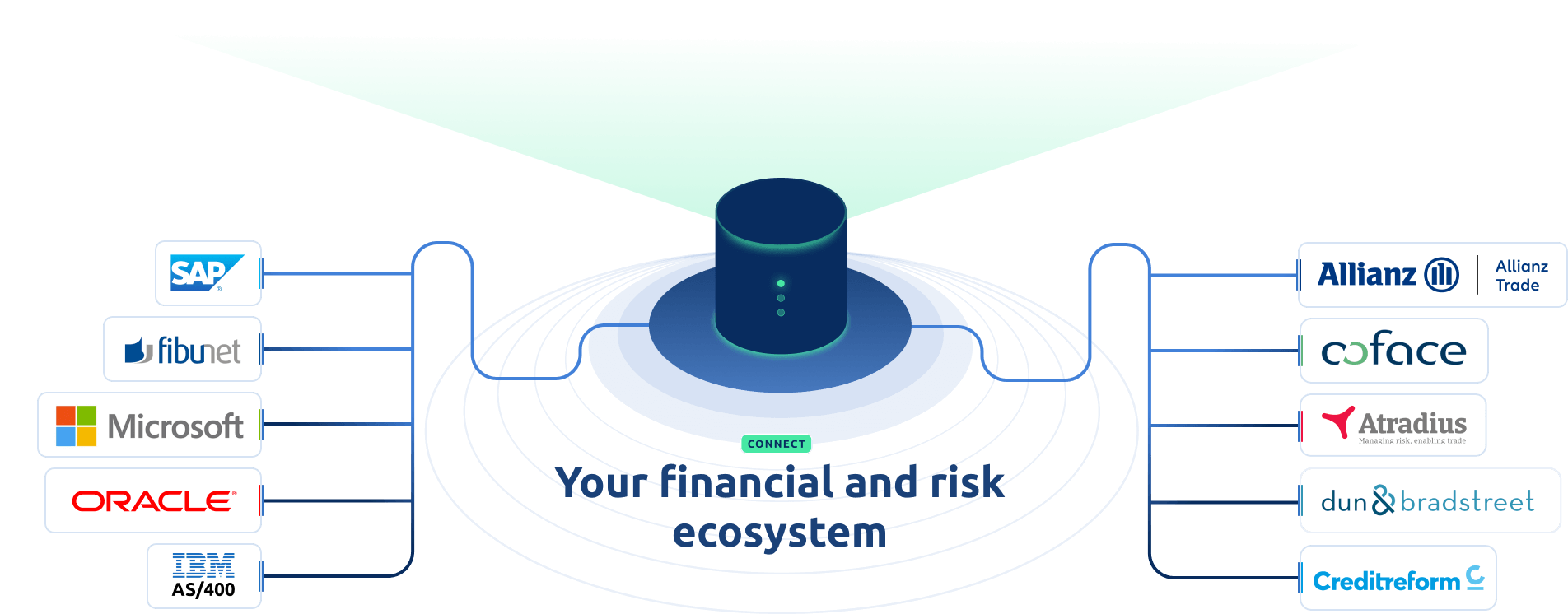

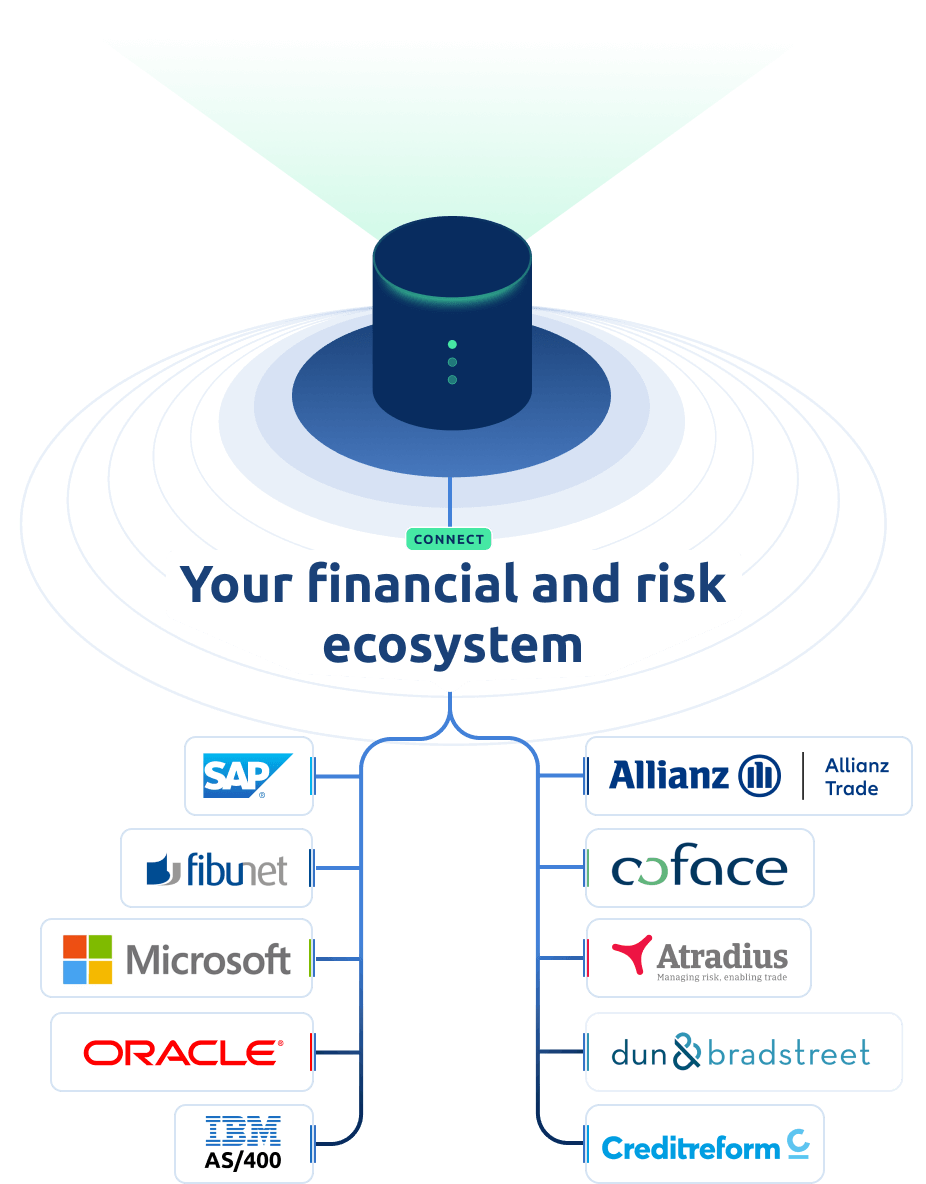

Integration

Onboarding your data has never been so straightforward. Thanks to flexible data middleware, Bilendo can quickly and effortlessly translate your data into the required target structure - with virtually no effort on the part of your IT team.

Kick-off to go-live

The average project duration from kick-off meeting to productive rollout is 83 days. We have made it our mission to further reduce this time so that all future customers can work quickly with the platform.

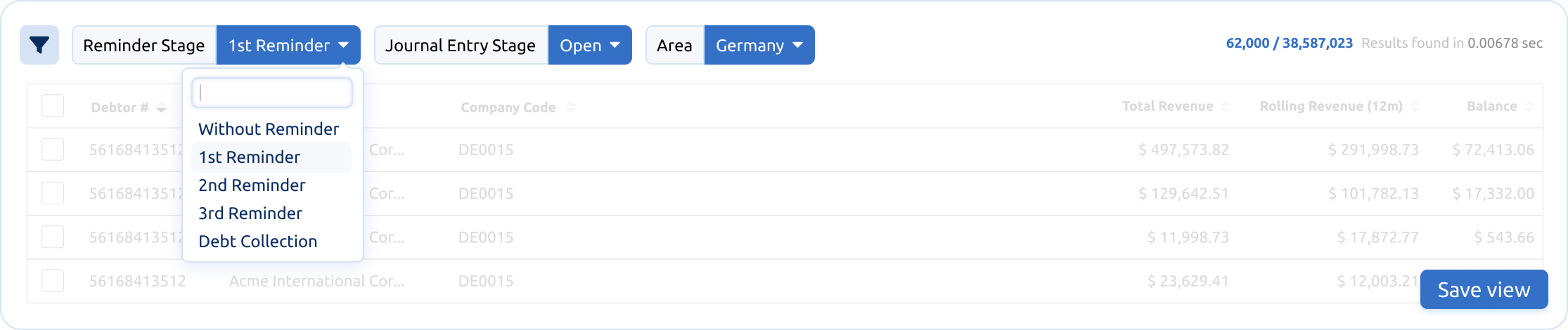

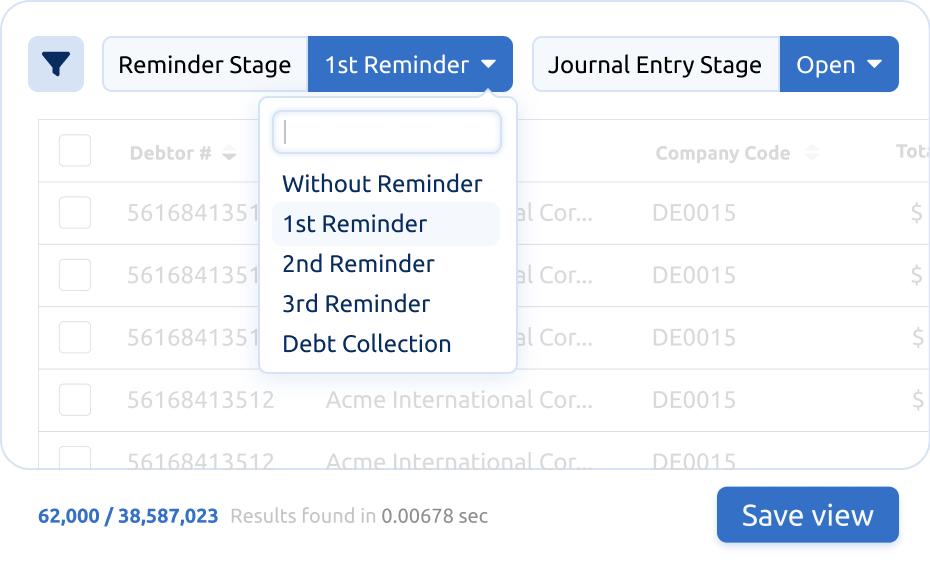

Bilendo is a modern cloud platform that has been specially developed for users who have little time but expect maximum efficiency. Thanks to the powerful filter and search functions, you can find exactly what you are looking for - regardless of the size of your data volumes.

Our user-friendly interface gives you quick access to your information so that you can concentrate on the essentials. With Bilendo, managing and analyzing your data is not only effective, but also intuitive and time-saving.

Intelligent search

Our intelligent search finds exactly what you need at lightning speed - precisely and reliably, even in large amounts of data.

Flexible worklist

Save relevant views and create individual work lists to keep a targeted overview.

Configurable list views

Easily create configurable list views that adapt perfectly to your needs.

Global search

Search Bilendo at the touch of a button and get to the information relevant to you in a flash.

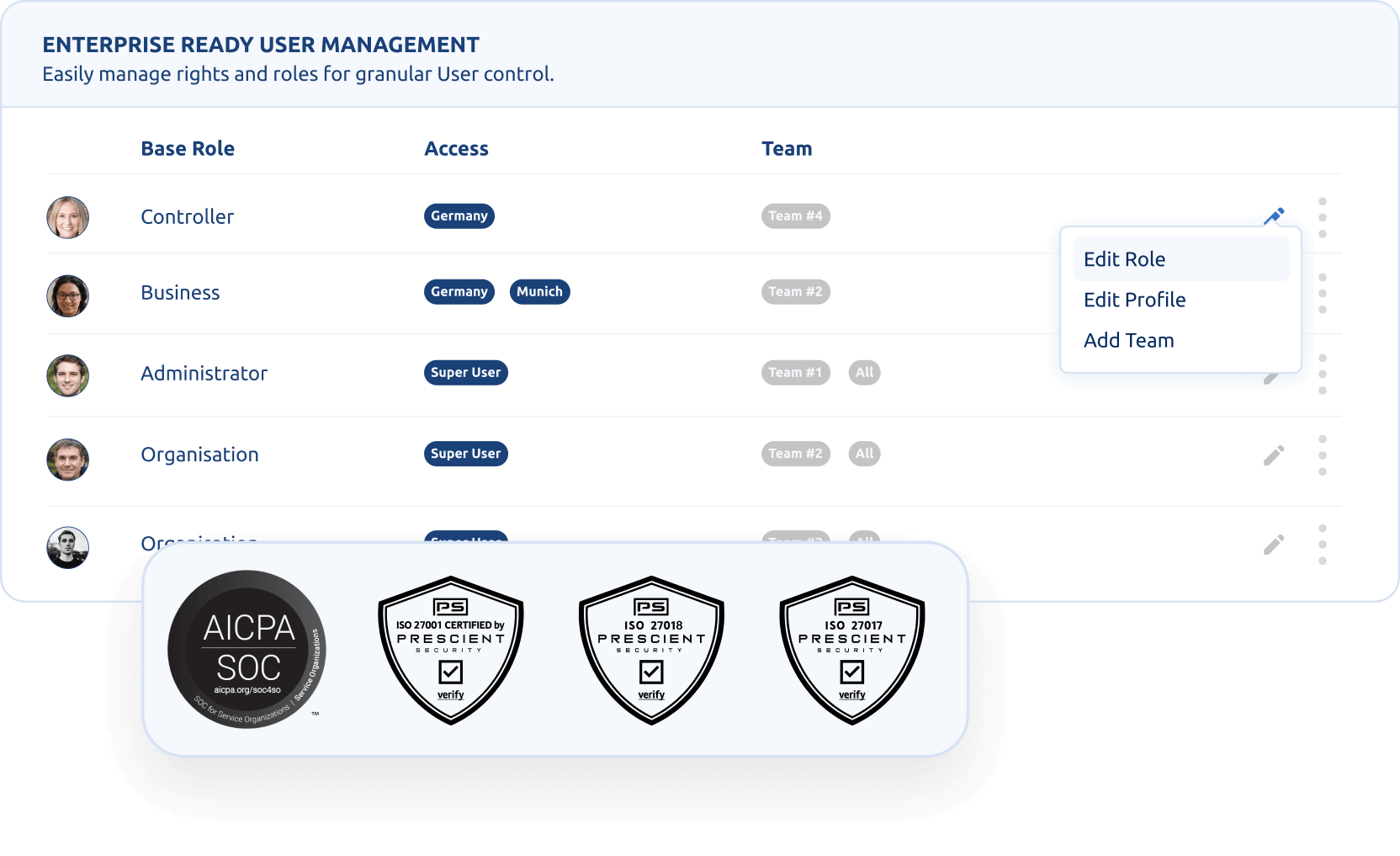

Data access & security

Our cloud platform offers the highest security standards with comprehensive protective measures. Individual access controls and modern security protocols ensure that your data is protected against unauthorized access and loss.

Flexible user roles

With customizable roles, you can provide your users with exactly the functions they need.

Limit data access

Simple restriction of the data that a user is allowed to see: whether specific company codes, business areas or customer groups - flexibly and with just a few clicks.

Numerous security options

SSO via SAML 2.0, user account locks and automatic locking of inactive accounts - we offer numerous options to ensure the security of your accounts.

Certified safety standards

Our high security standards are comprehensively safeguarded by certifications such as ISO/IEC 27001:2022, SOC2 Type 1+2, ISO/IEC 27017 and ISO/IEC 27018.

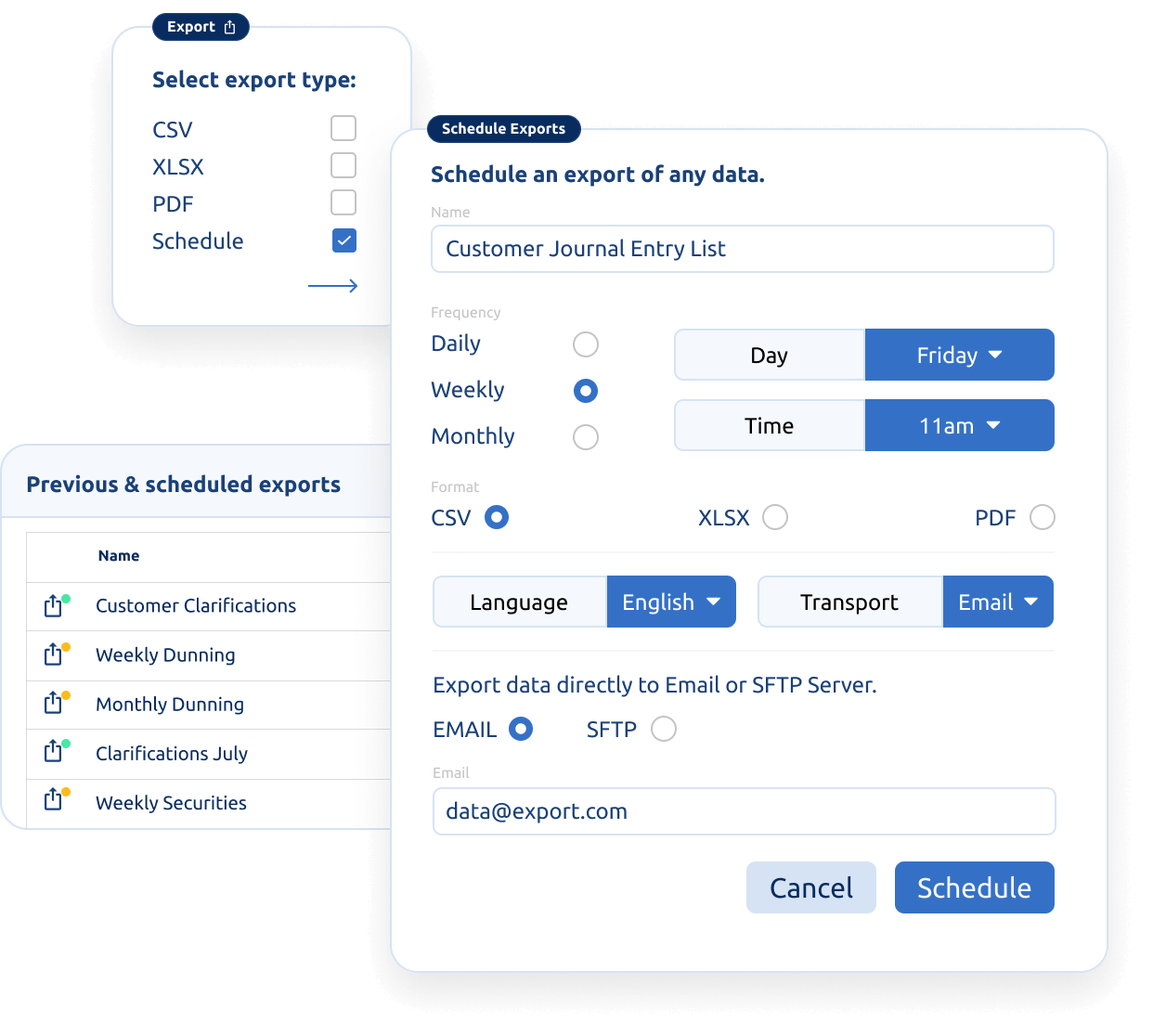

Bilendo not only allows you to import your data quickly, but also to export it just as quickly - just as you need it.

Flexible options

Export your data as required - by download, e-mail or SFTP. Automatic export options is also possible.

Various formats

Exports can be retrieved in various formats, usually including .csv, .xlsx and .pdf.

Regular exports

Would you like to receive certain exports regularly and automatically? In Bilendo, you can set up exports according to your schedule and receive them automatically.

Export Layouts

In the export layout, select which information is to be exported - individually for your company or for individual exports.

Self Service

Change Bilendo entirely according to your needs, without any IT or programming knowledge. Users with the appropriate authorizations can make all relevant settings themselves - quickly and easily, without support from Bilendo.

Product DemoRights & roles

Webhooks

Email server

User administration

Lettershops

SFTP server

Multi-currency

Password policy

Export layouts

Individual views

Aging-Filter

Multi-language

U.v.m

Cloud Platform +

Expand your accounts receivable processes with the additional products and add-ons available in Bilendo.